Page 23 - Moreno Valley 2019 Popular Annual Financial Report

P. 23

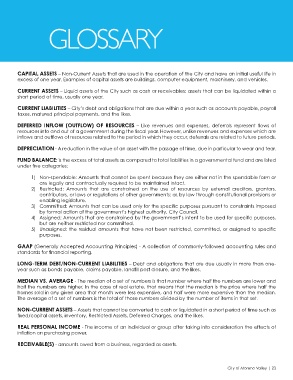

GLOSSARY

CAPITAL ASSETS – Non-Current Assets that are used in the operation of the City and have an initial useful life in

excess of one year. Examples of capital assets are buildings, computer equipment, machinery, and vehicles.

CURRENT ASSETS – Liquid assets of the City such as cash or receivables; assets that can be liquidated within a

short period of time, usually one year.

CURRENT LIABILITIES – City’s debt and obligations that are due within a year such as accounts payable, payroll

taxes, matured principal payments, and the likes.

DEFERRED INFLOW (OUTFLOW) OF RESOURCES – Like revenues and expenses, deferrals represent flows of

resources into and out of a government during the fiscal year. However, unlike revenues and expenses which are

inflows and outflows of resources related to the period in which they occur, deferrals are related to future periods.

DEPRECIATION - A reduction in the value of an asset with the passage of time, due in particular to wear and tear.

FUND BALANCE: is the excess of total assets as compared to total liabilities in a governmental fund and are listed

under five categories:

1) Non-spendable: Amounts that cannot be spent because they are either not in the spendable form or

are legally and contractually required to be maintained intact.

2) Restricted: Amounts that are constrained on the use of resources by external creditors, grantors,

contributors, or laws or regulations of other governments; or, by law through constitutional provisions or

enabling legislature.

3) Committed: Amounts that can be used only for the specific purposes pursuant to constraints imposed

by formal action of the government’s highest authority, City Council.

4) Assigned: Amounts that are constrained by the government’s intent to be used for specific purposes,

but are neither restricted nor committed.

5) Unassigned: the residual amounts that have not been restricted, committed, or assigned to specific

purposes.

GAAP (Generally Accepted Accounting Principles) - A collection of commonly-followed accounting rules and

standards for financial reporting.

LONG-TERM DEBT/NON-CURRENT LIABILITIES – Debt and obligations that are due usually in more than one-

year such as bonds payable, claims payable, landfill post closure, and the likes.

MEDIAN VS. AVERAGE - The median of a set of numbers is that number where half the numbers are lower and

half the numbers are higher. In the case of real estate, that means that the median is the price where half the

homes sold in any given area that month were less expensive, and half were more expensive than the median.

The average of a set of numbers is the total of those numbers divided by the number of items in that set.

NON-CURRENT ASSETS – Assets that cannot be converted to cash or liquidated in a short period of time such as

fixed/capital assets, inventory, Restricted Assets, Deferred Charges, and the likes.

REAL PERSONAL INCOME - The income of an individual or group after taking into consideration the effects of

inflation on purchasing power.

RECEIVABLE(S) - amounts owed from a business, regarded as assets.

City of Moreno Valley | 23